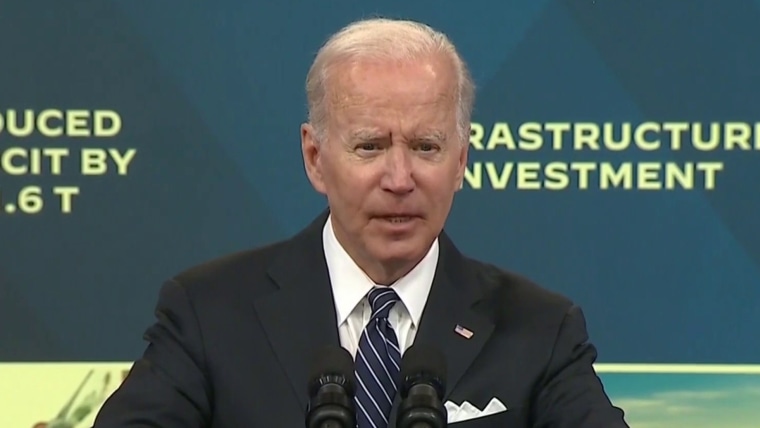

NEW ORLEANS — President Joe Biden’s administration on Friday proposed as much as 10 oil and gasoline lease gross sales within the Gulf of Mexico and one off the Alaska coast over the subsequent 5 years — going in opposition to the Democrat’s local weather guarantees however scaling again a Trump-era plan that referred to as for dozens of offshore drilling alternatives together with in undeveloped areas.

Inside Secretary Deb Haaland stated fewer than 11 lease gross sales — and even no lease gross sales in any respect — may happen, with a last resolution not due for months. New drilling off the Atlantic and Pacific coasts can be blocked, after being thought-about underneath Trump.

“President Biden and I’ve made clear our dedication to transition to a clear vitality financial system. Immediately, we put ahead a chance for the American individuals to … present enter on the way forward for offshore oil and gasoline leasing,″ stated Haaland, whose company oversees drilling on federal lands and waters.

The proposal introduced speedy backlash from each environmentalists — who accused Biden of betraying the local weather trigger — and oil business officers and allies, who stated it could do little to assist counter excessive vitality costs. Gasoline costs averaged $4.84 a gallon on Friday, a pressure on commuters and a political albatross for Biden’s fellow Democrats going into the midterm elections. That has left the White Home scrambling for options, together with Biden’s name final week for suspension of the 18.4 cents a gallon federal gasoline tax.

The Inside Division had suspended lease gross sales in late January due to local weather considerations however was pressured to renew them by a U.S. district choose in Louisiana.

The Biden administration cited conflicting courtroom rulings about that call when it canceled the final scheduled lease gross sales within the Gulf and Alaska in the course of the earlier offshore leasing cycle. That prior five-year cycle, a program adopted underneath former President Barack Obama, expired on Thursday.

There will likely be a months-long hole earlier than a brand new plan could be put in place. The oil business and its allies say the delay may trigger issues in planning new drilling and probably result in decreased oil manufacturing.

There’s unlikely to be an offshore lease sale till nicely into subsequent yr, stated Frank Macchiarola, senior vp of the American Petroleum Institute, the business’s high lobbying group.

And, he stated, administration officers “went out of their approach to say” there may not be any lease gross sales in any respect.

“It’s crucial for the administration to ship a sign to the worldwide oil markets that america is severe about rising provide … for the long run,” he stated, repeating a longtime declare by business officers and Republicans that ties uncertainty over oil provide to excessive costs.

Biden in latest weeks has criticized oil producers and refiners for maximizing income and making “extra money than God,” somewhat than rising manufacturing in response to increased costs because the financial system recovers from the pandemic and feels the results of Russia’s invasion of Ukraine.

The leasing announcement was a bitter disappointment to environmentalists and a few Democrats who rallied round then-candidate Biden when he promised to finish new drilling in federal lands and waters.

The proposal comes a day after the administration held its first onshore lease gross sales, drawing $22 million in an public sale that provides vitality corporations drilling rights on about 110 sq. miles (285 sq. kilometers) in seven western states. The gross sales got here regardless of the administration’s personal findings that burning oil and gasoline from the parcels may trigger billions of {dollars} in potential future local weather damages.

“Our public lands and waters are already liable for almost 1 / 4 of the nation’s carbon air pollution every year. Including any new lease gross sales to that equation whereas the local weather disaster is unfolding throughout us is nonsensical,” stated Home Pure Sources Committee Chairman Raul Grijalva, D-Arizona.

Cynthia Sartou, government director of the environmental nonprofit Wholesome Gulf, referred to as the lease-sale plan “an enormous loss for Gulf residents, American vitality coverage and the worldwide local weather.”

Reasonable Democrat Joe Manchin, who chairs the Senate vitality committee, welcomed the proposal as an opportunity “to get our leasing program again on monitor.”

“Whereas Individuals all over the place are affected by file excessive gasoline costs and disruptions within the international oil market brought on by (Russian chief Vladimir) Putin’s mindless conflict in Ukraine, the Division of the Inside hasn’t held any profitable offshore lease gross sales since November 2020,” the West Virginia lawmaker stated.

Underneath the Trump administration, Inside officers had proposed 47 gross sales, together with 12 within the Gulf of Mexico, 19 in Alaska and 9 off the Atlantic coast that have been later withdrawn. Trump misplaced the 2020 election earlier than the proposal was finalized.

The present format of holding Gulf-wide gross sales was put in place underneath Obama due to dwindling curiosity in offshore leases. Previous to that there had been a long time of regional gross sales.

Friday’s announcement opens a 90-day public remark interval, then a last plan have to be submitted 60 days earlier than it goes into impact.

The federal government held an offshore lease public sale within the Gulf of Mexico in November that introduced $192 million in bids. A courtroom canceled that sale earlier than the leases have been issued.

Haaland has stated beforehand that the business is “set” with the quantity of drilling permits stockpiled and at its disposal. She testified throughout a Home listening to in April that the business has about 9,000 permits which have been authorised however will not be getting used.

Oil manufacturing has elevated because the financial system recovers from the coronavirus slowdown, nevertheless it’s nonetheless under pre-pandemic ranges. Vitality corporations have been reluctant to ramp up manufacturing additional, citing a scarcity of staff and restraints from traders cautious that at this time’s excessive costs received’t final.

Main oil corporations reported surging income within the first quarter and despatched tens of billions of {dollars} in dividends to shareholders.

Athan Manuel of the Sierra Membership stated delaying offshore gross sales till subsequent yr “is a vital step towards defending communities and local weather, and we urge the administration to finalize a plan that commits to no new offshore drilling leases, interval.”